Romania`s credit ratings have never been the best compared with other countries in the region, either in absolute, or relative terms. This resulted in enough voices wondering on various occasions whether Romania might be discriminated against by the credit rating agencies in relation to its neighbors. A topic that I see resumed today.

Let us remind that Romania`s current long term foreign currency rating with both Standard&Poors and Fitch is BBB-, while with Moody’s it is Baa3. An observation right off the bat: for all the three most known credit rating agencies worldwide, Romania stands at the lower end of the “investment grade” credit ratings, i.e. of the category recommended for investments where it is joined by Hungary, and according to S&P`s assessment, by Bulgaria.

Let us remind that Romania`s current long term foreign currency rating with both Standard&Poors and Fitch is BBB-, while with Moody’s it is Baa3. An observation right off the bat: for all the three most known credit rating agencies worldwide, Romania stands at the lower end of the “investment grade” credit ratings, i.e. of the category recommended for investments where it is joined by Hungary, and according to S&P`s assessment, by Bulgaria.

Is Romania really discriminated against by all the three agencies by placing it at the bottom tier of investment grade credit ratings? Would it deserve a higher position alongside Poland, only two grades up according to S&P?

Putting aside the 10-year development gap separating Romania and Poland which has not been recovered in the span of two decades, Romania would continue to show significant shortcomings against countries such as Poland, in the eyes of credit rating agencies. And that has nothing to do with the tear gas recently used in the Victoriei Square as lately suggested by a ZF article.

As I mentioned in a previous post, democratic standards are not one of the credit rating agencies` criteria. Economic stability and predictability prevail. That takes me to the approach that I would like to put to you in order to understand credit rating agencies` doubts towards Romania.

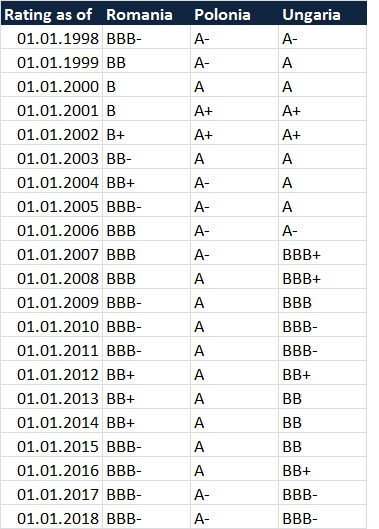

The table below shows Romania, Hungary and Poland`s records in relation to credit rating in the last 20 years.

Start counting and you will find that Romania`s rating has been changed nine times in 20 years, Hungary`s eleven times, whereas Poland`s only six times. Here we have a first indication of how important economic policy consistency and predictability are. The picture gets clearer when we count the times each country switched back and forth between investment and non-investment grades. Romania went twice through periods during which it was not recommended to investors, Hungary once and Poland never. These statistical data show by and large the impact of Romania`s “stop and go” policies and the inconsistency of its economic decisions which required repeated rating changes by specialist credit rating agencies. Having the highest growth rates in Europe remained irrelevant as long as they are known to be unsustainable.

Start counting and you will find that Romania`s rating has been changed nine times in 20 years, Hungary`s eleven times, whereas Poland`s only six times. Here we have a first indication of how important economic policy consistency and predictability are. The picture gets clearer when we count the times each country switched back and forth between investment and non-investment grades. Romania went twice through periods during which it was not recommended to investors, Hungary once and Poland never. These statistical data show by and large the impact of Romania`s “stop and go” policies and the inconsistency of its economic decisions which required repeated rating changes by specialist credit rating agencies. Having the highest growth rates in Europe remained irrelevant as long as they are known to be unsustainable.

These are the liabilities that Romania is bringing forward to credit rating agencies which are very well aware of the constraints of current economic policies. Unlike Romanian politicians who stubbornly advance a snapshot of the economic landscape, credit rating agencies do have professionals sufficiently trained to know that economic dynamics is what matters. And current changes give them no reason to be upbeat about future trends.

Under these circumstances, their doubts can be explained and ranking Romania two notches below Poland, with Hungary, becomes justifiable. The naivety with which many of Romania`s decision makers imagine that past blunders can be just washed away so that the international community considers Romania`s record spotless, continues to amaze me. Things could not have been more different and it will take at least one decade of impeccable economic governance for past errors to fade away. This is something that Romania has yet to deliver and cannot hope for a reboot.

At the end of the day, the call to courage should not be aimed at the credit rating agencies, but at those who are meant to make the economic policies more convincing and sustainable.

Have a nice weekend!