The decision by the rating agency Standard & Poor’s to downgrade Romania’s credit-rating outlook from stable to negative seems to have come as a surprise. I believe that the agency’s explanation was sufficiently clear to exclude any speculations: the large spending deviations of the former government will be difficult to correct by the current government given the upcoming elections.

The news matters because such a decision predicts a rating downgrade unless correction measures for previous deviations are taken. The stakes are high because Romania is already at the lower end of the investment grade range (BBB-) and further downgrades may have a major impact on investors` appetite to fund the budget. Many investment and pension funds have the restriction of buying only investment grade bonds. Once that label is lost, they have to sell their holdings.

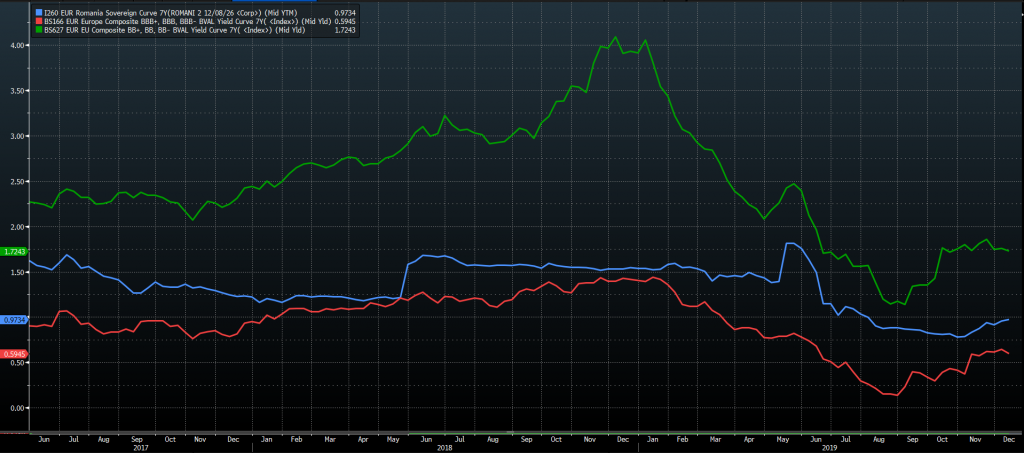

Looking at experts` reactions in the press I see some who, based on theory, foresee that “Romania`s borrowing costs are set to rise” as a result of the outlook change. That is correct on paper, but in practice we also have to look at context and trends. Putting the decision into perspective, I do not expect Romania’s financing costs to increase. The explanation lies in the graph below showing the changes in the 7-year Eurobond yield (blue line) against the average yield of bonds with the same BBB- rating (red line). Given that Bloomberg’s BBB- bond yield average includes both government and corporate bonds, the departure from other sovereign issuers may even be underestimated.

Romania has been for some time borrowing at a higher cost compared to issuers with a similar rating, but the departure started mid-2018 and reflected investors’ increasing concerns about Romania’s budgetary deviations. In other words, even if ratings agencies did not adjust at the time their opinions in relation to Romania, investors went one step ahead and pushed the country’s risk premium up. That is why we may infer that the changed S&P outlook has already been priced in with no other additional adjustments necessary. The agency’s decision, that is, will probably not be enough to raise the government’s borrowing costs.

Comparing it to BB+ bonds yields (green line), immediately below the investment grade category, we notice that investors are not predicting a slide of the country into that category as Romania’s financing costs are lower. At the same time, the yield spread heralds the extra financing cost to be expected should such a slide occur, which must be avoided at all costs.

Sadly, the signals I am seeing are worrying and show that the threats are not being grasped and the mistakes of the past ignored. That is my conclusion suggested by carrying on populist initiatives to cut taxes or excise duties or take on budgetary expenditure with no source of money identified. As they have demonstrated so far when dealing with that situation, investors will not sit and wait for a credit rating cut to start shunning Romanian bonds.

Only a new crisis and IMF’s involvement could bring us back to earth?

Have a nice weekend!