Tesla and Bitcoin, two extremely popular brands share a common trait: their skyrocketing market value. Since the beginning of 2020, Tesla`s share price has increased ninefold resulting in an overall value higher than that of Toyota, Volkswagen, Daimler, General Motors, BMW, Honda, Hyundai and Ford together. Clearly, some may say that Tesla is not a car manufacturer, but a tech company. It follows that comparing it to car manufacturers would not be fair.

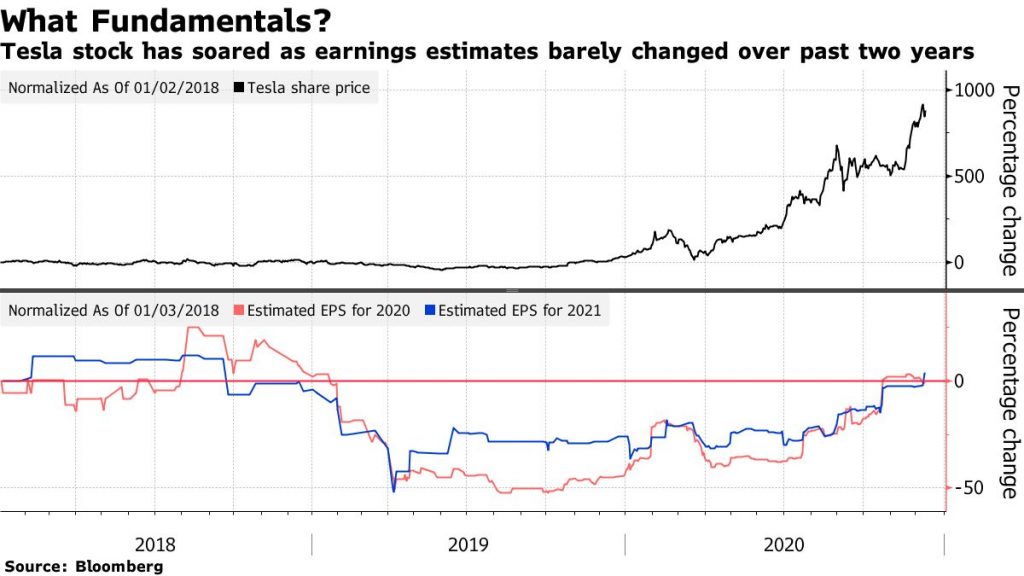

Let us, therefore, see how it fares against the likes of Amazon and Apple. Amazon’s P/E ratio (price-to-earning) stands at around 77, and Apple’s hovers around 36. Tesla’s P/E ratio is 1.250… No surprise there, as the company has only started to be profitable about a year ago.

Let us, therefore, see how it fares against the likes of Amazon and Apple. Amazon’s P/E ratio (price-to-earning) stands at around 77, and Apple’s hovers around 36. Tesla’s P/E ratio is 1.250… No surprise there, as the company has only started to be profitable about a year ago.

The graph below, courtesy of Bloomberg, gives a crystal clear picture of the disconnect between the company’s profitability, measured as earnings per share, and changes in its share price.

Some would argue that Tesla does not even derive these profits from making cars. In 2020, it reported a profit of $721 million as the company had earned $1.6 bn from the sale of CO2 credits. The company would have otherwise been in the red.

Bitcoin, on the other hand, confounds by its stellar performance which defies reason. Its market value is 90 times higher than five years ago and four times higher than last year. Moreover, its volatility was at times extreme, as its value halved in the first quarter of 2020 to later increase tenfold.

Volatility is key when looking at Tesla’s decision. Firstly, we need to agree that Tesla is an undertaking and not a hedge fund, betting on highs and lows. Indeed, such funds revel in making high-risk investments which can potentially come with high returns (or equally high losses).

So what could have pushed Tesla to buy such a fickle asset? Let us work on the assumption that its goal was not to get a particular individual rich. A bitcoin holder could have made a hefty profit on the 10% share price increase since Monday when Tesla announced that it had bought $1.5 billion worth of bitcoin, an amount exceeding the company’s R&D budget …

Could it then be a typical treasury investment by a company with cash to spare? According to conventional wisdom such investments are made in safe assets by companies interested more in preserving their capital for dividend payouts or in profit-generating activities within their scope and expertise. Investing in unstable assets would only adversely impact the company’s market value. That is one implication that Tesla not only overlooked but seemed to actively pursue.

Under the accounting method used to recognize Bitcoin holdings on the balance sheet, they will be recorded as indefinite-lived assets. As a result, the value of existing intangibles and goodwill will increase four times after the Bitcoin purchase. It is worth noting that classifying Bitcoin as intangible assets goes against Tesla’s call to recognize the cryptocurrency as a financial asset similar to well-established currencies, accounted for as financial assets.

This is not the only inconsistency. It is equally strange that a company which poses as an environmental advocate, invests in a cryptocurrency whose “mining” requires huge amounts of electric energy. Its rising price will only increase the appetite for an activity that uses resources without a clear economic value.

On the other hand, Tesla has informed the public about the accounting treatment of the Bitcoin position. It will be valued at cost if the market value exceeds that of purchase or at market if it is below costs. In other words, losses will be recognized in real time, whereas profits are recognized at sale alone. On the upside, such an asymmetric approach is set to lower the volatility of the related balance sheet position, but on the downside, it creates more uncertainty around the company’s valuation.

All ties with the fundamentals of economics will be severed by the excitement that will greet Tesla’s decision, coming from those driven by an unwavering trust in the God of technology who are also behind the inflating tech bubble. They could be the reason why Tesla’s Bitcoin purchase might be seen as a publicity stunt stirring up the emotions needed to drive Tesla’s (and Bitcoin’s) price to new record highs. A smokescreen getting thicker and misleading to investors.

According to Bloomberg, in December 2020, Morgan Stanley had a price target for Tesla of $540 per share, while JP Morgan’s price target was $90 per share.

Have a nice weekend!