There is a long-standing misunderstanding in the public mind. It must be corrected because it is significant. Many people ask when the next crisis is going to strike again, without clearly discriminating between recession and a full-blown crisis. A recession is due to follow relatively soon because it is part of cyclical economic changes which are normal to happen. Global economy has experienced economic growth for a sufficiently long period of time to have the likelihood of a recession increased.

I think we could be quite certain that, given a world economic recession, the Romanian economy will not escape recession. Our economic integration within the European area is sufficiently strong to be dragged down just as much as the upward shifts in the EU pushed us up. On the other hand, I fail to see how Romania could provide a Poland-like surprise, which during the financial crisis was the only European country to experience positive growth. How? By drawing in and making EU funds work for it. Romania is not there. Its procyclical fiscal policies set the ground for high economic volatility, exceeding the European average.

So, we are due a global recession in maximum 2 – 3 years… this is what most pundits seem to think. That is bound to trigger a recession in Romania, as well. It is actually the most likely scenario, as it is difficult to believe that the Romanian economy will go into recession in favorable international economic circumstances if we are to take only the many multinational companies present here and which manufacture only for external markets. They shore up the local GDP and keep local providers busy, themselves producers of added value.

Will there be a recession follow by crisis in Romania? It depends. It is fairly easily to steer out of recession if you prepare for it. If it takes you by surprise, it can easily turn into a crisis. The bad news is that Romania is not prepared to ride out a recession. It is unprepared because our main source of economic incentives, the budget, is overstretched, now, at times of growth. Unfortunately, it is maxed out because of expenditure commitments which are extremely hard to reverse.

In a recession, budget revenues fall at the same rate as the economy does. Expenditures cannot be adjusted as fast since they include salaries and pensions. At most, we will see redundancies being made. People will no longer be able to repay their loans, or people who stop fuelling consumption. On the other hand, the government debt costs will increase as investors become significantly wearier and their risk appetite plummets. Been there, done that, although we must admit that, this time round, the economic adjustment will probably be less dramatic than in 2009 – 2010 as the current account deficit is much lower, but, mind you, on the increase.

Having said that, the next question is probably: How likely is a global recession which will catch Romania off-guard?

One cannot say for certain when the global economy will go into recession, but there are already signs of growth stagnation which often times is the peak of an extended period of economic growth, usually followed by recession. Germany`s and Japan`s economies, two large exporters worldwide, shrank in Q3. The annualized growth rate decrease in Germany is 0.8% and it is the first quarterly drop in three and a half years and the weakest result since 2013. Japan saw an annualized growth rate decrease of 1.2% after an increase by 3% in the previous quarter. It remains to be seen if these are just fleeting trends caused by the earthquake and the typhoon in Japan or the German car industry predicament.

On the other hand, large exporters, such as Germany, Japan or China are highly likely to suffer from protectionism compounded by the US-China trade war, which is why businesses take precautions and review their forecasts. Please also note the sensitivity of the American stock market to news about the changes in the US-China economic relations. Initially they welcomed the news of a temporary truce in the US – China trade war with a market high, but the news about legal actions being brought against the Huawei Chief Financial Officer in the US caused the market to fall again.

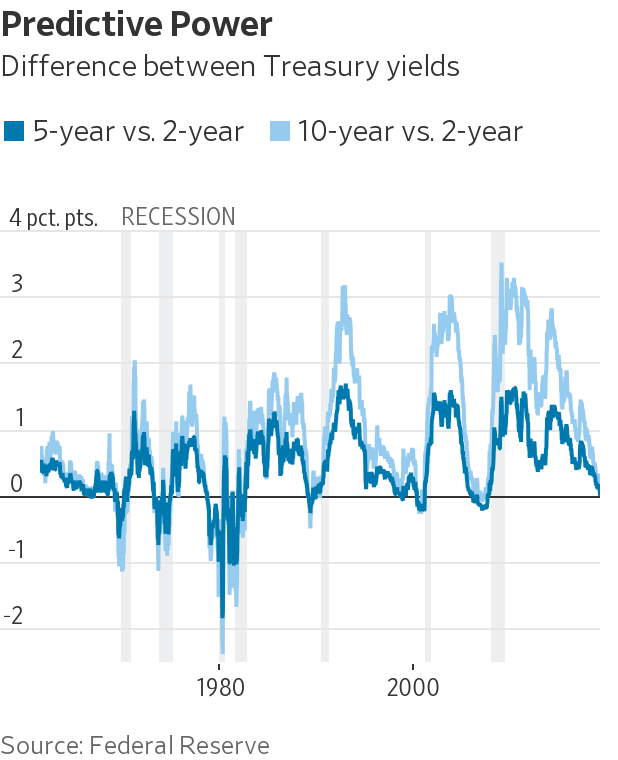

There is another element in the US which is starting to cause concern: the yield gap between short-term and long-term T-bonds hitting levels close to zero. Investors remember that, historically, most times in which the 10-year bond yield dropped below the two-year bond yield, have been followed by recession. The graph below published by the Wall Street Journal is most revealing. It marks the changes in spreads for 2-year / 5-year bond yields and 2-year / 10-year bond yields. The link between their negative value and recession periods in grey is obvious. And even though we are not currently in the red, it is clear that investors are bracing up for a significant slowdown in the economic growth, at least.

There is another element in the US which is starting to cause concern: the yield gap between short-term and long-term T-bonds hitting levels close to zero. Investors remember that, historically, most times in which the 10-year bond yield dropped below the two-year bond yield, have been followed by recession. The graph below published by the Wall Street Journal is most revealing. It marks the changes in spreads for 2-year / 5-year bond yields and 2-year / 10-year bond yields. The link between their negative value and recession periods in grey is obvious. And even though we are not currently in the red, it is clear that investors are bracing up for a significant slowdown in the economic growth, at least.

It is worth noting that this is a belief held strongly enough that not even the upbeat forecasts by the chiefs of the three largest US banks cannot change. At a Goldman Sachs conference, all three chairmen of JP Morgan Chase, Wells Fargo and Bank of America appreciated the economic conditions in the US to be exceptionally sound and referred to consumption trends and business confidence. Alas, during their address, their optimism was contradicted by the stocks of the three banks which dropped by between 4.5 and 5.5% on top of the 3.2% drop in the Standard&Poors rating.

I would conclude by saying that those in Romania who interpret the future economic trends based on the recent ones are making a serious mistake which could turn a plain recession into a crisis. And I am not referring to political decision-makers alone. A recent Romanian Business Leaders survey conducted among its own members showed that 57% of them see the global prospects over the next 12 months go down or stay put, while almost 70% expect to see them go up or stay the same in Romania. Someone, somewhere is wrong.

Have a nice weekend!

Subscribe to receive notifications when new articles are published