We are in a difficult period of transition with no compass for guidance. Despite desperate attempts to make the future more predictable by looking at past economic crises, I am convinced without a doubt that no previous experience that mankind has lived through has any bearing on present and future developments. The events and changes over the past ten years, as well as current ones are so unusual, the solutions by main decision-makers so unorthodox, that no one really knows where we are all headed. No time for strategies. Everything seems to unfold rather according to tactical arrangements, over the short term and improvising on the go based on what happens.

There is another likely scenario to be added to this atypical picture, which cannot be overlooked: the possible end to the US dollar hegemony. The Bretton Woods accords in 1944 enshrined the dollar as the world’s reserve currency. The US had immense gold reserves which allowed it to back all the dollar bills in circulation. The global main currencies were tied to the dollar and the dollar was tied to gold. The dollar status has not changed over time, not even when President Nixon decided to take the dollar off gold. The dollar appeal remained unscathed, underpinned by the importance of the US economy in the global economy and trade, the size of the US financial markets, the credibility of a superpower as was the US or the luring power of low-risk US Treasury bonds. They all helped the dollar to be one of the few backup assets where most investors took shelter in troubled times.

But that primacy is about to change. A clue as to its attractiveness dropping may be found in the significantly growing appetite for gold or digital currency, considered an alternative to the dollar. The reasons are many.

Firstly, it is the economic sanctions that America has been using this past decade and thought by many analysts and members of academia as excessive. These sanctions, applied long term, end up forcing countries such as China, Russia or Iran, into finding alternatives to trading with the US and using the US dollar. It is what recently happened when the Chinese and Russian central banks significantly decreased their dollar assets to increase gold reserves. A similar trend is also manifest as far as owning US Treasury bonds are concerned.

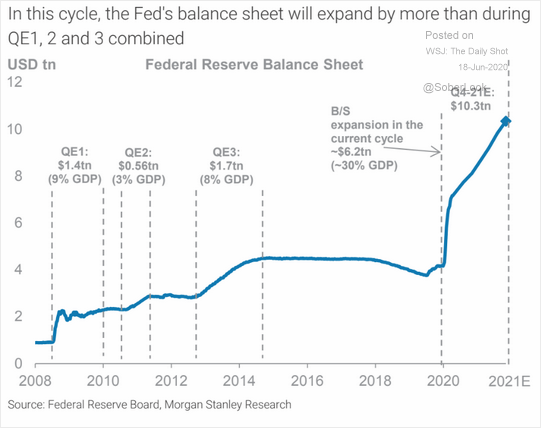

Secondly, it is the casualness with which the FED started to “print” money in unimaginable amounts to fund public spending to pay for the pandemic and maintain dollar liquidity. As shown by the graph below, the measures taken in the 2008 crisis, considered exceptional at the time pale by comparison with the FED’s actions this year.

The issuance by the FED of trillions of dollars with no backing, has raised and continues to raise ever more questions as to how the US currency will continue to play the part bestowed on a reserve currency: value preservation. In these circumstances, growing interest in gold or cryptocurrency investments should not come as a surprise. The fact that some central banks are considering to issue cryptocurrency themselves may be interpreted as a decision keeping up with the times. Ironically, I see it as a vote of non-confidence against there own currencies that they have been issuing and which they are about to destabilize by massive printing.

Besides these developments which are on the verge of costing the dollar its credibility, there is another question worth asking: is it still in the US’s interest to maintain dollar hegemony on global financial markets? There are some who say No putting forward a series of arguments worth pondering over. The gist is that as the importance of the US economy decreases globally, maintaining the role of the dollar becomes more and more expensive at home.

The appeal of investment opportunities in the US, in both zero-risk instruments, such as T-bonds, and certain industries, have always led to a strong inflow of dollars into the United States. This does not only allow the country to have a substantial current account deficit, living beyond its means, but it also causes social and financial polarization to increase in the US. The main capital inflow recipients are the financial industry and big business to the detriment of the manufacturing sector and its employees who must experience the aftermath of a too strong a dollar. In this case, it will be extremely difficult to reverse the de-industrialization process in the US caused by businesses relocating abroad. As an aside, it should be said that despite promises made upon its election, president Trump has completely failed to decrease the trade deficit with China.

Clearly, the world continues to want a strong dollar just as it wants to see the US military and political presence preserved. It does, however, ignore the costs involved in having the US military compete against the ever brazen emerging economies or in maintaining dollar dominance despite the relative drop in the country’s economic relevance. Everybody wishes for a free lunch paid by the US.

That, though, raises the immediate question of What will replace the dollar? A legitimate wonderment as neither the euro area, nor China is ready to pick up the slack. In the best-case scenario proposed by Foreign Affairs the US, the EU and China create a currency basket to be used in international trade under the IMF’s watchful eye. The less optimal, but more realistic version is that the Sino-American tensions will render such a deal impossible which would lead to a series of capital flow restrictions, especially the speculative kind, diminishing unilaterally the dollar status.

At the end of the day, the currency of a great power losing its hegemonic status would not be a first. Great Britain and the pound stand proof.

Have a nice weekend!

Subscribe to receive notifications when new articles are published