In theory, the NBR (National Bank of Romania) has been aiming to hit inflation targets for more than a decade. In other words, every year it tried to stay inside the inflation range that it had previously announced. But there is quite a gap between theory and practice which is by no means a narrow one.

The first country to implement inflation targeting was New Zealand in December 1989. An IMF survey updated half way through 2017 listed 28 countries which had adopted inflation targeting. In theory, the main benefit of the policy is the central banks’ commitment to making sure that inflation changes in a way that matches previously set targets. That would cause the business environment to be more predictable and confine stakeholders` inflationary expectations to the central bank`s forecasts.

At the same time, that should also increase the predictability of the central bank`s monetary policy decisions as businesses are now aware of the reference system used as a benchmark when the bank decides on interest rate changes. The end result should be a virtuous circle where low inflation expectations would ultimately lead to decreased inflation and its maintenance within the specified range. That equals a stable low inflation rate. But this happens only when all the inflation targeting requirements are strictly met …

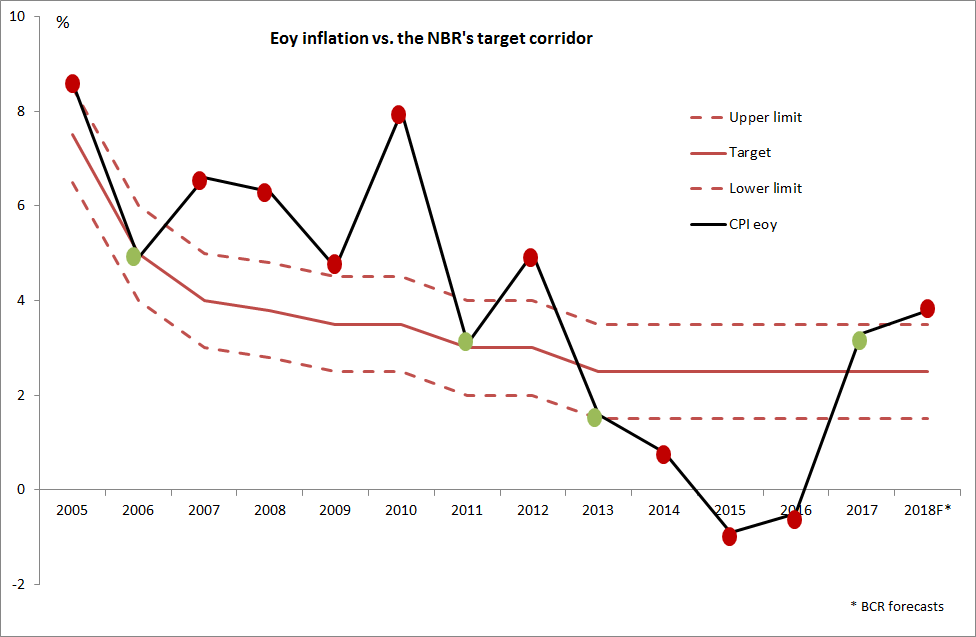

Inflation targeting was first adopted by the NBR in August 2005 and its success in hitting set targets is perfectly reflected by the graph below. It has failed 9 times, and on just 4 occasions did it achieve its target.

Should that come as a surprise? No. Over the years the requirements associated to an inflation-targeting regime have only partially been met. When the NBR launched the policy, it considered that it was doing so at the right time given the ongoing process of fiscal consolidation and better fiscal and monetary policies linkages. Indeed, theory says that coordination between fiscal and monetary policies is a pre-requisite of successful inflation targeting. Alas, that was not Romania`s case where pro-cyclical fiscal policies only fuelled inflation and made achieving set inflation targets harder.

Another important requirement mentioned in a IMF paper is “the wish and ability of the central bank not to target other indicators, such as wages, unemployment or exchange rates”. Even the NBR made the case for introducing inflation targeting by making reference to the “relative exchange rate flexibility”. But not once did the NBR stop using the exchange rate as a nominal anchor. The proof of that lies in the unusual situation Romania found itself in throughout a time that has seen the least volatile exchange rate in the region but the most volatile short-term interest rates. Even today, as shown below, the concern is about the exchange rate even as inflation is moving outside the target range.

Finally, the credibility of the central bank as an independent institution was a key factor which I do believe has been maintained successfully. What was less successfully upheld was its credibility as a central bank able to hit the inflation targets that it had set. Announcing the targets is a powerful tool only in so far as businesses trust that the central bank has tools solid enough to help it meet them. How credible is the NBR`s ability to hit set targets now after so many failures?

Under these circumstances, I believe that a recent statement by the bank`s Governor is undermining the very foundation of inflation targeting. He stated: ”We do not wish to combat inflation whilst deepening the current account deficit and harming competitiveness. A too steep interest rate increase will have capital flow in and the exchange rate go up. (…) If we were an institution with blinders on, looking only at the CPI (consumer price index – Ed.): Meeting the target is all I`m after! A higher exchange rate would be the easiest way to go.”

I perfectly agree with the whole thing. A question, though, remains: what`s left of inflation targeting given that in 2018, as the inflation rate is about to exceed the set range, the central bank`s message is that of being unwilling to fight inflation (that is to guide it to a targeted level) for fear of worsening the exchange rate, competitiveness and the current account deficit. The answer is that not much, and inflation targeting remains nothing more than window dressing.

Could the NBR give up inflation targeting? No, it couldn`t. It is doomed to pursue it because a message of giving up would have much worse market implications than the consistent failure to meet the target. Moreover, what better strategy would they bring in as a replacement? The IMF paper does mention that the countries stopping inflation targeting only did so after joining the euro area, a path which the NBR is likely to also follow.

Meanwhile we should continue to expect a “soft” inflation targeting, with some trying to meet it, while others trying to believe the promises of the former.

Have a nice weekend!

Subscribe to receive notifications when new articles are published