In the US, in the UK, in the eurozone, in the EU, the inflation surpasses even the worst-case scenarios. The reasons behind it are presented as “exogenous”, namely they are somehow extrinsic, beyond the central banks’ control. But are they truly exogenous only? And are central banks truly firefighters to the rescue or are they just putting out the fire they started themselves?

“Economics is not an exact science. It’s a combination of an art and elements of science”, said Paul Samuelson, the first American to win the Nobel Prize in Economic Sciences. I cannot but agree with him and, in my opinion, the unpredictability of human behavior is the main issue here. In the end, human decisions dictate the level of supply and demand in any economy, whether we talk labor, capital or attitude towards consumption/saving. The globalization added complexity to all economic processes, which only made it less likely for the accuracy of economic sciences to improve.

Therefore, central banks are, in their decision making process, far from having a toolkit able to provide firm estimates about future economic developments, about the right time for intervening or about the consequences of such interventions. Despite the complex economic modeling they use, in the end, they still make sure to adjust it to an “expert opinion”. Meaning an “educated guess” of market analysts and experts. This may be the “art” part Samuelson was talking about.

Current and expected developments thus form the basis for monetary policy decisions made by central banks. As long as these decisions were kept within the conventional routes, the risks related to the approximations that came with the inaccuracy of economic sciences have not been significant. The effects of the central banks’ measures meant to manage the market liquidity and adjust the reserve requirements or the interest rates fluctuations produced effects in the economy, gradual adjustments, but never shocks.

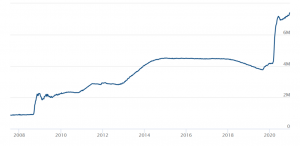

However, the risks of assessment errors increased significantly once the logic of “conventional” interventions was disregarded, more precisely once they decided to release the “atomic bomb” of quantitative easing. Banning central banks from purchasing the debt of their own country has been, until the 2008 crisis, engraved in scarlet letters on the first page of any monetary policy ABC. The reason behind it was the inflationary consequences that such an approach, involving the printing of money, would cause.

But this fundamental prohibition was wiped out during the 2008 crisis when the exceptional market circumstances called for exceptional interventions from the central banks to prevent the total financial market foreclosure. Yet, the money printing drug, which soothed the pains of the economic crisis at first, has been stubbornly used for a decade to eventually turn addictive. Governments and financial markets alike became the prisoners of free money printed by the central banks in order to finance national budget deficits and boost the economy.

The tipping point was reached with the pandemic, when the liquidity injections surpassed even those of the 2008 crisis. If this solution worked without causing inflation back then, it had to work this time, too, right?

Value of Fed assets

The problem is that such an unhealthy connection between central banks, governments and financial markets cost the central banks most of their independence. An independence that should have given central banks the freedom to intervene as needed so as to reach their primary goal: price stability. But now, reversing the quantitative easing policies became increasingly hard to do, given its impact on the governments’ capacity to finance the deficits or the negative impact on stock market trends.

When you want to use a high-impact bomb in a war to get the expected results with minimum collateral damage, you need precision guidance equipment. And yet, the central banks decided to guide the ballistic missile of quantitative easing using a compass. At first, the bomb was powerful enough to make believe it reached its target. But now they see that reaching the target was due to the large-scale shock instead of its precision. Because central banks appear to have forgotten that economics is not an exact science.

Illustrative for this is the mishandling of the inflation which was “transitory” enough to be ignored, then was no longer “transitory” and required decisive interventions from the central banks.

The problem is that, despite the lack of economic models which provide for an accurate assessment of consequences, the central banks used up the money printing option during the pandemic, concerned with containing the economic recession and supporting the governments. Practically, they underestimated the strong economic recovery they were about to cause hand in hand with the governments that used the free money to pay out subsidies and other economic incentives.

Instead of a gradual economic recovery that would have allowed businesses to adjust their modus operandi through a seamless transition, the aggregate demand shock induced major tensions to the global supply chains, the energy markets, the labor markets. They all came together under the common denominator of generalized price increases.

It is hard to otherwise explain why the pre-pandemic economic balances were good enough and put no pressure on prices while, later on, a recovery of the economy to the pre-pandemic levels had such a strong impact on prices worldwide. The explanation can only be the recovery shock caused by an excessive dose of stimuli.

Add to this mix the shock of the clean energy transition… Because this transition is a shock in itself. The transformations that energy industries must undergo are fundamental, require capital and time, above all. Or the last thing you want in such an energy transition is an overlap with an economic boom where energy demand soars. So although the agendas of major central banks and governments affirm in bold, green letters their concern for sustainability criteria, they are now partly responsible for the re-start of coal-fired power plants, due to the demand shock they triggered.

Let’s hope that, after having played with the magic wand long enough, like the sorcerer’s apprentices, the central banks will put it back in the box and stop believing in the magic of long term money printing that causes no inflation.

Subscribe to receive notifications when new articles are published