Most often than not, global crises force humanity into change, greatly stepping up processes that were rather slow to develop. At this point in time, also, developments that initially would have taken decades to complete will be moving into top gear with major effects in just a matter of years.

From this perspective, it is not the oil price collapse that should come as a surprise, but the speed at which it is unfolding. I am saying that because this was the inevitable end for a humanity that has acknowledged that for too long did it remain the captive hostage of fossil fuel consumption with devastating consequences for the entire planet.

The oil industry was already losing steam and the interest of investors. The percentage held by the energy sector is down to just 4% of the S&P 500, the lowest on record. Carbon emission targets agreed internationally could only lead towards one direction: abandoning oil as a source of energy. And rightfully so.

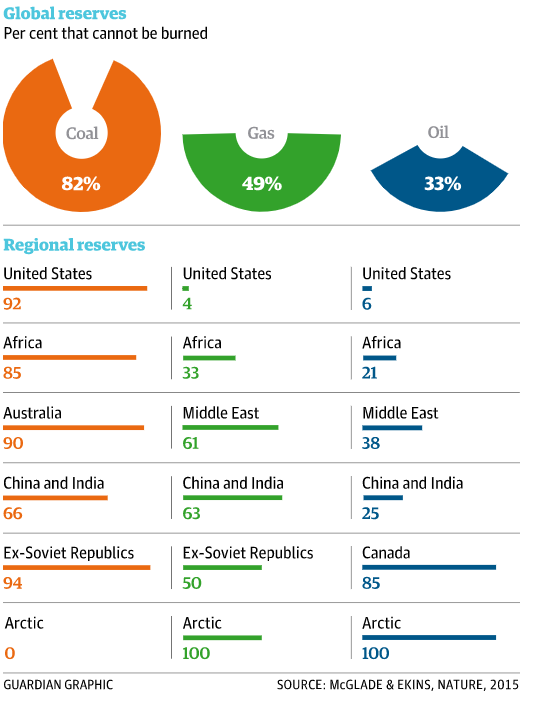

Five years ago, the Nature magazine published an analysis by the University College London (UCL), that assessed the amount of oil that would remain unused till 2050 should countries around the world take all the necessary steps to prevent an average temperature rise by more than 2 degrees Celsius. According to the study, 82% of global coal reserves, 49% of gas and 33% of oil reserved would remain unused. The adjoining picture of the Guardian newspaper shows the breakdown of unused reserves by geographical areas. Opinions have not shifted in the intervening years and the big oil producers admit this as a fact. Indeed, in July 2019, the head of strategy of British Petroleum, a behemoth company, acknowledged that some oil resources will stay in the ground, especially reserves that are too expensive to get out. Even Saudi Arabia issued a very strong signal in this respect when a few years back it launched The Vision 2030 program, a strategy meant to basically significantly reduce the kingdom’s reliance on oil revenues by fostering investments inside and outside the country in fields of the future.

Five years ago, the Nature magazine published an analysis by the University College London (UCL), that assessed the amount of oil that would remain unused till 2050 should countries around the world take all the necessary steps to prevent an average temperature rise by more than 2 degrees Celsius. According to the study, 82% of global coal reserves, 49% of gas and 33% of oil reserved would remain unused. The adjoining picture of the Guardian newspaper shows the breakdown of unused reserves by geographical areas. Opinions have not shifted in the intervening years and the big oil producers admit this as a fact. Indeed, in July 2019, the head of strategy of British Petroleum, a behemoth company, acknowledged that some oil resources will stay in the ground, especially reserves that are too expensive to get out. Even Saudi Arabia issued a very strong signal in this respect when a few years back it launched The Vision 2030 program, a strategy meant to basically significantly reduce the kingdom’s reliance on oil revenues by fostering investments inside and outside the country in fields of the future.

And here we are at a time when the collapse of transport services has beamed us decades into the future in just a few weeks. Oil is no longer a coveted asset and oil companies will have no choice but to shut down wells and leave the fuel in the ground. In the hope of better times?

Those better times for oil producers wouldn’t make sense to ever come back, even though we should expect the transport industry to gradually pick up pace. Till then though, oil producers will most likely go through a very strict process of triage. In the States, for example, there are about 5,000 oil producers, 10% of oil being extracted by the so called “mom-and-pop” companies, meaning small family-owned businesses. They will be among the most likely first victims, with mid-size companies that have been using debt to fund their activity likely to follow suit.

Consolidation across the industry is unavoidable. The oil majors alone will probably survive. As far as countries are concerned, those with the lowest operating costs will be the best positioned in a world of low prices. As I explained on another occasion, as some of the reserves will most likely never see the light of day, maximizing revenue will no longer be possible through high prices, but by tapping out available reserves. More simply put, between selling just 50% of reserves at $45 the barrel and selling 100% of reserves at $25 a barrel, it makes more economic sense to choose the latter, although the price is lower.

Given all this, a state such as Saudi Arabia will be well positioned to set the tone as it has one of the lowest oil operating costs. It is not by chance that the price war which broke out at the beginning of the year was started by no other than Saudi Arabia. It remains to be seen if the US, with significantly higher costs, will let it maintain these extremely low price levels which would push American producers off the market. Recent developments would suggest that it is not willing to stand by and watch. But it would eventually only lead to a reallocation of the reserves to have to stay in the ground at Saudi Arabia’s expense.

A thought may be haunting us: will we be returning in 3, 4, 5 years to pre-crisis oil consumption and pollution? I tend to think that we won’t. Restarting the economy will be done by pumping huge amounts of money into the hard-hit economies. No country, however rich, will be able to ignore the logic of investing in the fields of the future that have the potential to drive the technological transformation. No one will afford the luxury to bet huge amounts of money on a “dead horse”. And the oil industry is a dying horse, a death that could be helped along by advancing preferential loans to green sectors: generating green energy that does not rely on fossil fuels.

Can this be taken for granted? Certainly not. The past decade has shown that lobbying from oil majors should not be underestimated. Their diversification, however, towards industries that are independent from fossil fuel use has started , is set to continue, and may even be stepped up. It follows that bitter opposition will be losing steam.

Have a nice weekend!

Subscribe to receive notifications when new articles are published