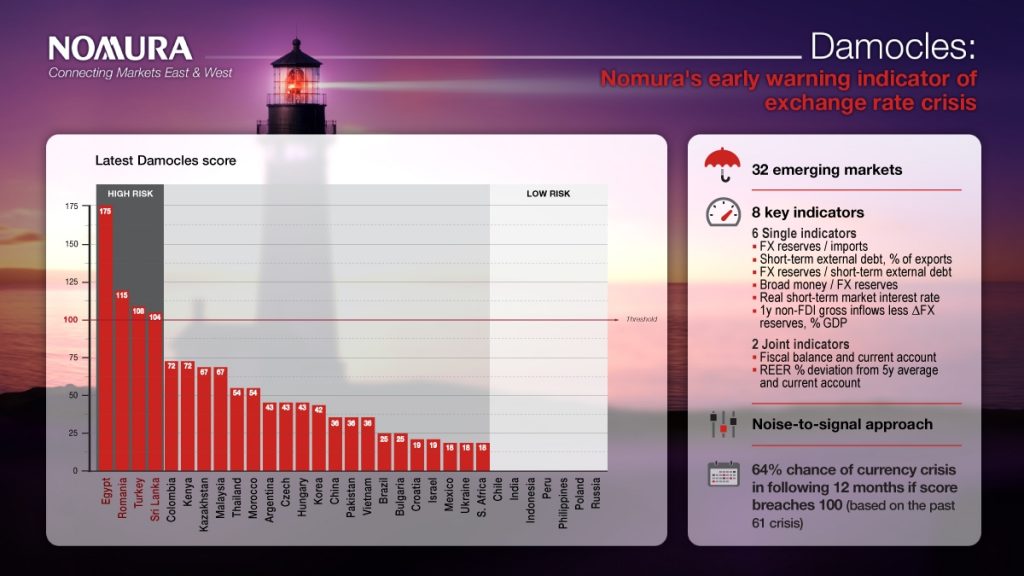

A recent study by well-known Japanese bank Nomura nominates Romania as the second most vulnerable country to an exchange rate crisis after Egypt. In third and fourth place are Turkey and Sri Lanka, respectively.

The alert threshold is defined as the value of 100 of the index, a breach of this threshold being interpreted as a warning that the economy is vulnerable to an exchange rate crisis within the next 12 months. By setting the threshold at 100, the model, called Damocles, was found to have predicted 64% of the 61 crises that occurred in the 32 countries under observation over the last 25 years.

Nomura’s model uses a number of key indicators such as: FX reserves to imports ratio, % of short-term external debt to exports, FX reserves to short-term external debt ratio, broad money to FX reserves ratio, real short-term interest rates, one year FDI gross inflows (less variation in FX reserves) as % of GDP.

The nomination of Romania on such a list can undoubtedly lead to a self-fulfilling prophecy by the fact that hedge funds, as well as the businesses, could be encouraged to bet on the depreciation of the RON and take currency positions accordingly.

Relevant to our discussion is also Nomura’s observation that, from the lessons of past crises, we can see that the risk premiums associated with some countries do not evolve smoothly. They do not increase gradually as the risk profile increases, but have a binary on-off character, triggering rather suddenly the risk-off.

What happened in Romania in such situations in the past? Probably the most relevant example is the famous “speculative attack on the leu” in autumn 2008.

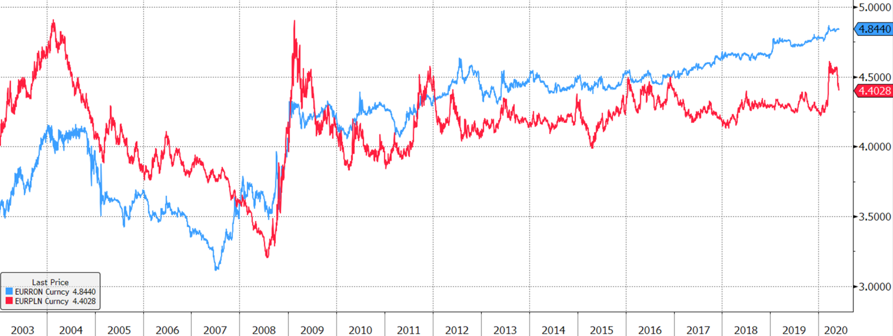

Well, now, for accuracy, I should say that, actually, that much talked about speculative attack did not only target the leu, but also other currencies in the region such as the zloty and the forint. Moreover, the Poles seemed to watch the depreciation of the zloty much more detached than we did, with the zloty depreciating even more than the leu in those days, as the chart below shows.

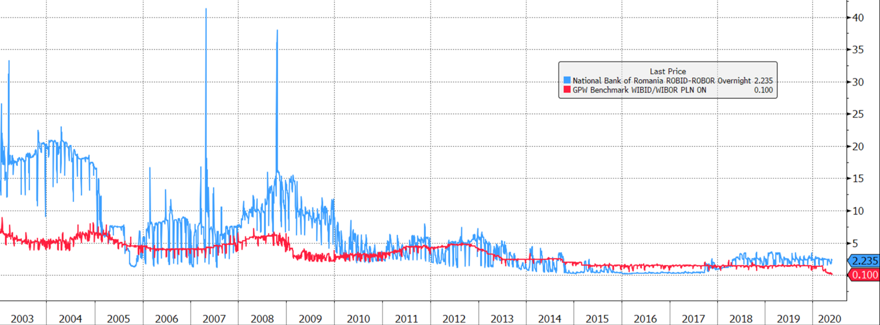

However, what set Romania apart in that context was the way the central bank reacted. Unlike Poland, which prioritized interest rate stability over exchange rate stability, BNR prioritized limiting exchange rate depreciation at the cost of extreme short-term interest rate volatility, as the chart below shows.

In other words, the strategy was to make the leu very expensive and difficult to access so that the positions of those who borrowed lei to buy currency (carry trade) became unprofitable.

But past developments are no guarantee of future developments, are they? Hence the question: faced with a similar situation again, would BNR react in the same way or would it allow, following the Polish model, the emergence of a currency shock reflected in a significant depreciation of the leu to benefit the interest rate stability?

The answer comes from the Governor who, in an address a few weeks ago, said:

“We are still rated high on country risk. When the correction is done through market mechanisms, it is much harder to control. It affects the exchange rate, not much more hard currency will enter Romania. If we now have an extraordinary reserve, even if we protect the pressure on the exchange rate, liquidity will disappear from the market and interest rates will rise. It depends on how this fiscal correction will be done. We might witness, without us fiddling with the monetary policy rate at all, an increase in market interest rates, if we do not have the strength to make fiscal adjustment and consolidation with the instruments at our disposal. We won’t even get to the point of reaching an agreement with the IMF.”

In other words, BNR’s priorities and implementation strategy remain similar to those of 2008. Stabilization of the exchange rate remains the number one priority and it will be defended at the cost of interest rate volatility.

So, to answer the question in the title, given BNR’s past behavior, as well as the Governor’s recent message, the chances of a currency crisis are rather moderate to low, while the risk of extreme short-term interest rate volatility is increasing. Such an outlook is unlikely to encourage a rapid fall in interest rates in the banking system. There is no such thing as a free lunch.

Have a nice weekend!

Subscribe to receive notifications when new articles are published